Gold has long been a symbol of wealth and security, and many consider purchase gold bars or investing in gold bars as a smart and rewarding choice. Whether you're a seasoned investor or a first-time buyer, purchasing gold bars can be an excellent way to diversify your investment portfolio. This guide will walk you through the basics of purchasing gold bars, from understanding types of gold bars to key considerations when making your purchase.

Why Purchase Gold Bars?

Gold bars are one of the purest forms of gold investments. Unlike jewelry or coins, which often come with added costs for craftsmanship and design, gold bars represent a straightforward investment in gold itself. This makes them popular with both individual investors and institutions aiming for long-term wealth preservation. Gold bars are easy to store, highly liquid, and typically have lower premiums over the gold spot price than other forms of gold.

Key Considerations When Purchasing Gold Bars

When considering a purchase, there are a few essential factors to keep in mind to ensure you make the best decision for your goals.

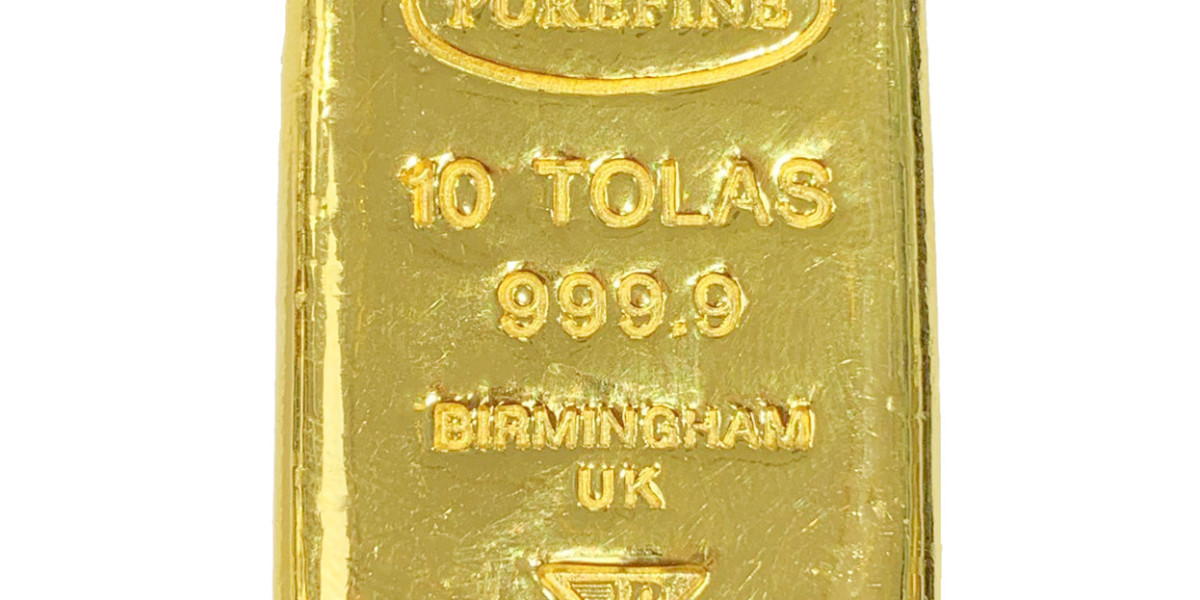

Purity of Gold Bars

- Gold bars generally come in high purity, usually ranging from 99.5% to 99.99% pure gold. This level of purity, especially in investment-grade bars, is higher than many other forms of gold and ensures that the investment holds intrinsic value.

- When purchasing, check the gold bar's certification and hallmark, often provided by a reputable refinery or mint, to verify its authenticity.

Weight and Size Options

- Gold bars come in a range of sizes, from small 1-gram bars to large 1-kilogram options or even heavier. The choice of weight depends on your budget and investment goals. Smaller bars are more affordable and easier to sell if you plan to liquidate a portion of your holdings, while larger bars offer a lower premium relative to the spot price.

- The most commonly purchased gold bars are 1-ounce, 100-gram, and 1-kilogram bars due to their balance between value and practicality.

Cost and Premiums

- The price of gold bars is typically based on the current spot price of gold, with an added premium. The premium covers manufacturing, distribution, and dealer profit, and it can vary based on the bar's weight and brand.

- Larger bars generally have a lower premium percentage compared to smaller bars, making them a cost-effective option for serious investors.

Reputable Sources and Certification

- Always purchase gold bars from a reputable dealer or mint. Trusted sellers offer certified gold bars that come with documentation, including a serial number and a certificate of authenticity.

- Well-known refineries like the Royal Canadian Mint, Perth Mint, PAMP Suisse, and Johnson Matthey are popular choices and are recognized globally for their high standards.

Storage and Security

- Proper storage is crucial for safeguarding your gold bars. Many investors opt for secure vaults or bank safety deposit boxes. Some dealers also offer secure storage solutions as part of the purchase process.

- Alternatively, some investors keep gold bars at home, although this requires a reliable safe and adequate insurance.

Benefits of Purchasing Gold Bars Over Jewelry or Coins

Gold bars are often favored for investment purposes over jewelry and gold coins. Here’s why:

- Cost Efficiency: Unlike jewelry, gold bars do not include additional costs associated with intricate designs or manufacturing. You pay for the gold content and a small premium, making it an efficient way to invest in gold.

- Higher Purity: Gold bars are often purer than jewelry and many gold coins, as they are made specifically for investment purposes.

- Easier to Liquidate: When you want to sell, gold bars are generally easier to liquidate than jewelry, which may require a specialized buyer. The standard weight and purity of bars make them appealing to a broader range of buyers.

Where to Purchase Gold Bars

Gold bars can be purchased from a variety of outlets, including:

- Banks and Financial Institutions: Some banks and financial institutions sell gold bars directly to consumers.

- Online Retailers: Many online platforms specialize in gold sales. Always research and confirm the retailer's legitimacy and customer reviews.

- Local Dealers and Jewelers: In some regions, licensed jewelers and dealers also offer gold bars. Make sure they provide certified products.

Tips for First-Time Buyers

If you’re a first-time buyer, start with a smaller gold bar to understand the market and the process. Educate yourself on current gold prices and trends, and make purchases gradually as you become more comfortable. Additionally, ensure that you’re buying from certified sellers and storing your gold securely.

The Role of Gold Bars in a Diversified Portfolio

purchase gold bars in your portfolio can act as a hedge against economic downturns, currency devaluation, and inflation. Unlike stocks or real estate, gold typically retains its value and can even appreciate during financial instability, making it an attractive asset for wealth preservation.

Conclusion

Purchasing gold bars is a timeless way to secure wealth and create a resilient investment strategy. Whether you’re looking to buy a single bar or build a portfolio, gold bars offer a straightforward path to owning a valuable, tangible asset. By purchasing from reputable sources, choosing the right size, and securing proper storage, you can make a gold bar investment that stands the test of time and adds a layer of security to your financial future.

Visit Us : https://www.a1mint.com/